santa clara property tax rate 2021

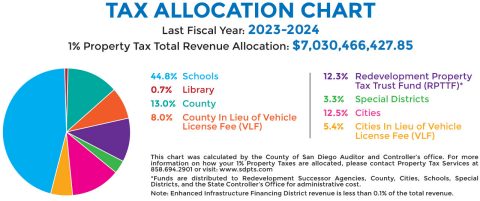

The chart shows the Countywide distribution of the 1. Property Taxes are made up of.

Measure E Transfer Tax In San Jose Valley Of Heart S Delight Blog

Santa Clara County Importation Water-Misc District.

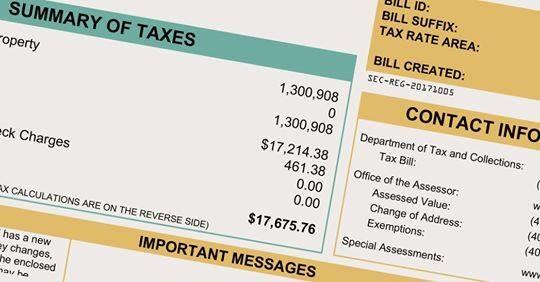

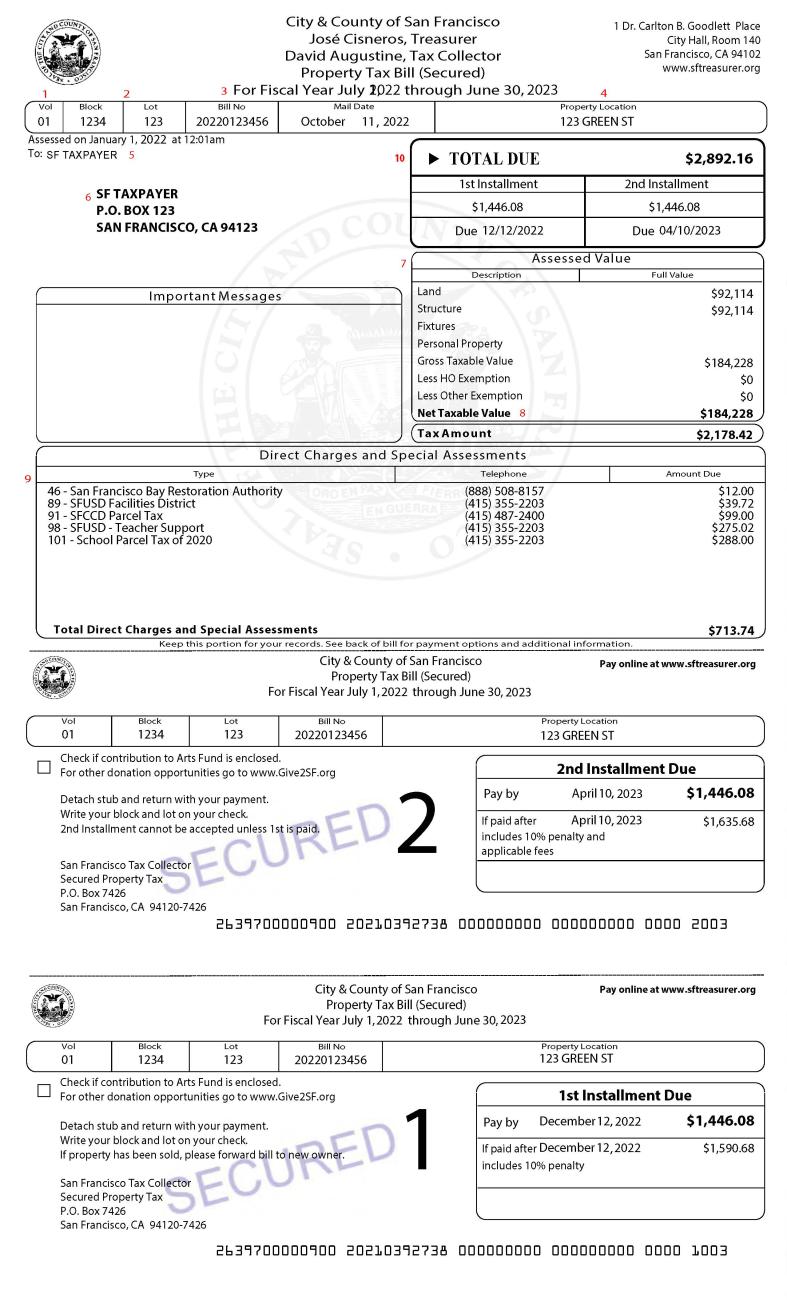

. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The California sales tax rate is currently.

The Department of Tax and Collections next online Public Auction tentatively set for October 28 2022 to October 31 2022 has been postponed. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. 1788 rows Santa Clara.

While business property owners must continue to file a Business Property Statement Form 571 each year detailing the cost of all supplies equipment improvements and land owned at each. Santa clara property tax rate 2021 Thursday August 4 2022 Edit The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a. Santa Clara Bridge District No01.

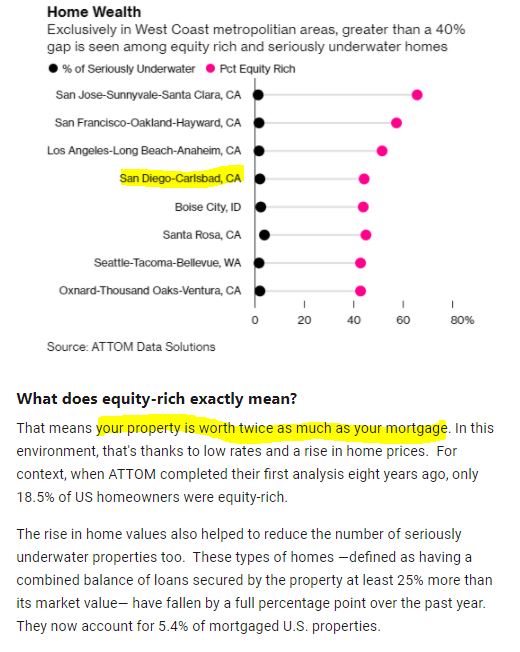

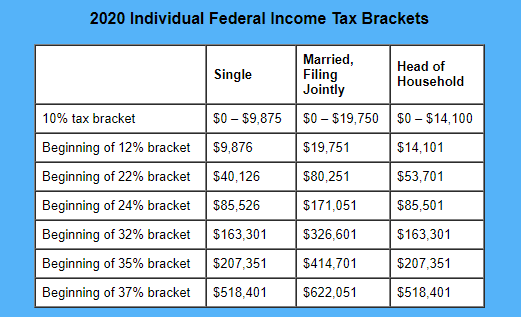

1 assessed-value property tax. The minimum combined 2022 sales tax rate for Santa Clara California is. The average effective property tax rate in Santa Clara County is 073.

The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. The median property tax in. Elements of Property Taxes.

Santa Clara County property tax rate. Total tax rate Property tax. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

There is no applicable city tax. This is the total of state county and city sales tax rates. You can print a.

Effective April 1 2021 Proposition 19 permits eligible homeowners defined as over 55 severely disabled or whose homes were destroyed by wildfire or disaster to transfer their primary. Santa Barbara campus rate. Yearly median tax in Santa Clara County.

Santa Clara County collects on average 067 of a propertys. The bills will be available online to be viewedpaid on the same day. The bills will be available online to be viewedpaid on the same day.

The bills will be available online to be viewedpaid on the. The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa Clara County sales tax and 2875 Special tax.

Property Values And Property Taxes Washington County Of Utah

Property Tax Re Assessment Bubbleinfo Com

Bay Area Property Tax Rolls Are Up 6 7 This Year It S Next Year Assessors Worry About

Property Tax California H R Block

Los Angeles Property Tax Which Cities Pay The Least And The Most

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Secured Property Taxes Treasurer Tax Collector

Guest View Who S Exempt From Parcel Taxes In Santa Clara County Morgan Hill Times Morgan Hill San Martin Ca

Reminder First Installment Of 2018 2019 Property Taxes Due Nov 1 County Of Santa Clara Mdash Nextdoor Nextdoor

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Low Tax Rates Provide Opportunity To Cash Out With Dividends

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Related Santa Clara City Of Santa Clara

Santa Clara County California Ballot Measures Ballotpedia

How To Calculate Property Tax Everything You Need To Know New Venture Escrow